Learn How to Place Stop Loss

Discover effective strategies for placing stop-loss orders in your trades. Minimize risks and protect your investments with expert techniques.

How to Place Stop Loss: A Comprehensive Guide

If you’re involved in the world of trading and investments, you’re likely aware of the crucial role that risk management plays in maintaining a successful portfolio. One of the most essential tools at your disposal for effective risk management is the “stop loss” order. In this guide, we’ll delve into what a stop loss is, why it’s important, and how to place it effectively to safeguard your investments.

Table of Contents

1.Introduction

2.Understanding Stop Loss

- Defining Stop Loss

- The Importance of Stop Loss

3.Factors to Consider Before Placing Stop Loss

- Volatility of the Market

- Investment Goals and Risk Tolerance

- Technical Analysis

4.Types of Stop Loss Orders

- Market Order Stop Loss

- Limit Order Stop Loss

- Trailing Stop Loss

- Guaranteed Stop Loss

5.Placing Stop Loss Step by Step

- Determine Support and Resistance Levels

- Set a Percentage or Dollar Amount

- Adjusting Stop Loss as Trade Progresses

6.Common Mistakes to Avoid

- Placing Stop Loss Too Close

- Ignoring Market Conditions

- Emotional Decision Making

7.Benefits of Using Stop Loss Orders

- Protection Against Market Gaps

- Elimination of Emotional Trading

- Consistent Risk Management

8.Real-Life Examples of Effective Stop Loss Placement

9.When to Reevaluate and Adjust Stop Loss

- News and Announcements

- Long-Term vs. Short-Term Investments

Understanding Stop Loss

Defining Stop Loss

A stop loss is a predefined order placed with a broker to automatically sell a security when it reaches a specific price point. This tool is designed to limit potential losses by ensuring that a trade is exited before losses accumulate beyond a certain threshold.

The Importance of Stop Loss

Stop loss orders are crucial for both new and experienced traders. They act as a safety net, preventing a small loss from turning into a substantial financial setback. Without a stop loss in place, emotions and market fluctuations can lead to hasty decisions, resulting in larger losses.

Factors to Consider Before Placing Stop Loss

Volatility of the Market

The volatility of the market greatly influences the placement of a stop loss. In highly volatile markets, wider stop loss margins are often necessary to account for rapid price swings.

Investment Goals and Risk Tolerance

Your investment goals and risk tolerance should dictate the placement of your stop loss. Conservative investors may opt for tighter stop losses, while aggressive investors might allow for more flexibility.

Technical Analysis

Your investment goals and risk tolerance should dictate the placement of your stop loss. Conservative investors may opt for tighter stop losses, while aggressive investors might allow for more flexibility.

Types of Stop Loss Orders

Market Order Stop Loss

A market order stop loss is executed at the prevailing market price once the specified stop price is reached. This can lead to potential slippage during high market volatility.

Limit Order Stop Loss

A limit order stop loss is triggered once the stop price is reached, but it’s executed at a specific price or better. This helps control the selling price, but there’s a possibility the trade might not execute if the price doesn’t reach the limit.

Trailing Stop Loss

A trailing stop loss moves with the market price. It’s designed to protect profits by allowing a trade to remain open and continue profiting as long as the market moves in the trade’s favor.

Guaranteed Stop Loss

A guaranteed stop loss ensures that the trade is closed at the specified price, regardless of market gaps or slippage. It provides an extra layer of security, but it might come with additional costs.

Placing Stop Loss Step by Step

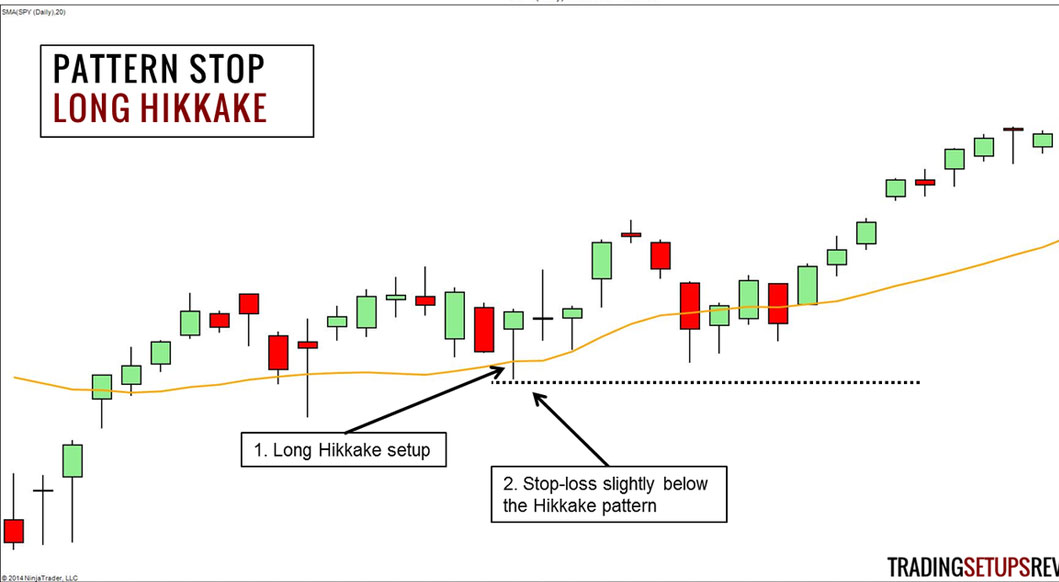

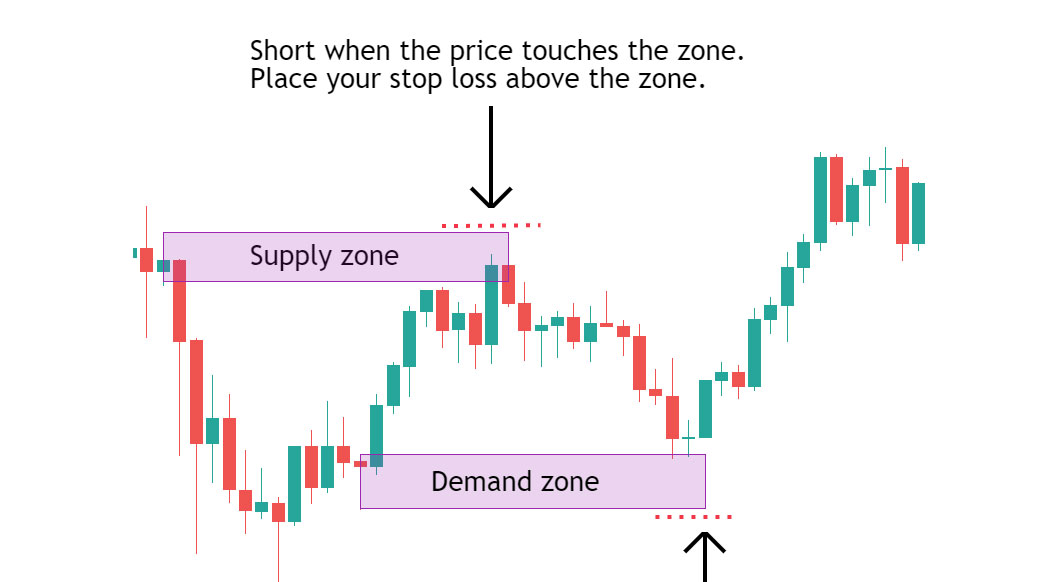

Determine Support and Resistance Levels

Identify key support and resistance levels through technical analysis. These levels can help you choose appropriate stop loss points based on potential price reversals.

Set a Percentage or Dollar Amount

Decide whether to set your stop loss based on a percentage of the investment or a specific dollar amount. This choice should align with your risk tolerance and investment strategy.

Adjusting Stop Loss as Trade Progresses

Monitor the trade’s progress and adjust the stop loss accordingly. As the trade moves in your favor, consider moving the stop loss to lock in profits and reduce potential losses.

Common Mistakes to Avoid

Placing Stop Loss Too Close

Placing a stop loss too close to the entry point can lead to premature trade closures due to minor price fluctuations, depriving the trade of room to breathe.

Ignoring Market Conditions

Failing to consider current market conditions, such as news releases or economic events, can expose your trade to unnecessary risk.

Emotional Decision Making

Allowing emotions to dictate stop loss placement can lead to irrational decisions. It’s essential to stick to your predetermined strategy.

Benefits of Using Stop Loss Orders

Protection Against Market Gaps

Stop loss orders protect against market gaps that can occur during after-hours trading or due to unforeseen events.

Elimination of Emotional Trading

Using stop loss orders removes emotions from the trading equation, ensuring that decisions are based on logic and strategy rather than fear or greed.

Consistent Risk Management

Stop losses enable consistent risk management across different trades, helping you maintain a balanced portfolio.

Real-Life Examples of Effective Stop Loss Placement

Illustrate the concept with real-life scenarios where effective stop loss placement saved traders from significant losses.

When to Reevaluate and Adjust Stop Loss

News and Announcements

Major news and announcements can impact market sentiment. Reevaluate and adjust stop losses to account for potential market reactions.

Long-Term vs. Short-Term Investments

Long-term investments may require less frequent adjustments to stop losses compared to short-term trades.

Conclusion

Placing a stop loss is a critical aspect of successful trading and investment. By implementing effective stop loss strategies, you can protect your capital, reduce emotional trading, and maintain a disciplined approach to risk management.

FAQs

What is a stop loss order?

A stop loss order is a predetermined order to sell a security when it reaches a specific price, aiming to limit potential losses.

Can I adjust my stop loss once it's set?

Yes, you can and should adjust your stop loss as the trade progresses to lock in profits and protect against losses.

Are there different types of stop loss orders?

Yes, there are market order stop losses, limit order stop losses, trailing stop losses, and guaranteed stop losses.

Is emotional trading dangerous?

Yes, emotional trading can lead to impulsive decisions that might not align with your strategy.

When should I reevaluate my stop loss?

Reevaluate your stop loss when there are major news events or significant market developments that could impact your trade.