Best Penny Stocks 2025

Penny Stock List 2024 – Market Capitalization

In this article, we have compiled the best penny stocks list in India between the price range of ₹ 0 – 25.

| नं. | Penny Stocks Name | Market Cap | Value (₹) |

| 1 | Yes Bank Ltd | 46,584.19 | 16.2 |

| 2 | Indian Overseas Bank | 46,405.42 | 24.55 |

| 3 | Vodafone Idea Ltd | 37,726.76 | 7.75 |

| 4 | Suzlon Energy Ltd | 15,422.32 | 14 |

| 5 | Alok Industries Ltd | 8,887.78 | 17.9 |

| 6 | Reliance Power Ltd | 5,602.81 | 15 |

| 7 | Jaiprakash Power Ventures Ltd | 4,180.61 | 6.1 |

| 8 | Infibeam Avenues Ltd | 4,158.13 | 15.6 |

| 9 | South Indian Bank Ltd | 3,819.25 | 18.25 |

| 10 | Sindhu Trade Links Ltd | 3,540.27 | 23.75 |

Cheapest Penny Stocks [2024]

| स्टॉक नाम | मूल्य (₹) |

| Pressure Sensitive Systems India Ltd | 7.6 |

| KBS India Ltd | 10.07 |

| Spacenet Enterprises India Ltd | 17.75 |

| Goldstar Power Ltd | 7.2 |

| IFL Enterprises Ltd | 15.1 |

| SBC Exports Ltd | 19.95 |

| AKI India Ltd | 22.94 |

| Artemis Electricals and Projects Ltd | 15.11 |

| Integra Garments and Textiles Ltd | 5.85 |

| Capital Trade Links Ltd | 22.95 |

Penny Stocks NSE

| स्टॉक नाम | मूल्य (₹) | पी / ई अनुपात |

| Hindustan Motors Ltd | 15.15 | 6,359.94 |

| Rajnish Wellness Ltd | 14.56 | 4,083.57 |

| Media Matrix Worldwide Ltd | 12.2 | 2,032.57 |

| Andrew Yule & Co Ltd | 24.65 | 1,023.26 |

| IFL Enterprises Ltd | 15.1 | 674.62 |

| KBS India Ltd | 10.07 | 607.80 |

| Spacenet Enterprises India Ltd | 17.75 | 336.94 |

| Urja Global Ltd | 9.8 | 269.75 |

| Vakrangee Ltd | 16.5 | 174.94 |

| Nandan Denim Ltd | 21.3 | 10.37 |

Penny Stocks BSE

| स्टॉक नाम | मार्केट कैप (₹ करोड़) | समापन मूल्य (₹) |

| Yes Bank Ltd | 46,584.19 | 16.2 |

| Indian Overseas Bank | 46,405.42 | 24.55 |

| Vodafone Idea Ltd | 37,726.76 | 7.75 |

| Suzlon Energy Ltd | 15,422.32 | 14 |

| Alok Industries Ltd | 8,887.78 | 17.9 |

| Reliance Power Ltd | 5,602.81 | 15 |

| Jaiprakash Power Ventures Ltd | 4,180.61 | 6.1 |

| Infibeam Avenues Ltd | 4,158.13 | 15.6 |

| South Indian Bank Ltd | 3,819.25 | 18.25 |

| Sindhu Trade Links Ltd | 3,540.27 | 23.75 |

Debt Free Penny Stocks

| स्टॉक नाम | मूल्य (₹) |

| 3P Land Holdings Ltd | 17.10 |

| BSEL Infrastructure Realty Ltd | 4.55 |

| Blue Chip India Ltd | 0.45 |

| Diligent Media Corporation Ltd | 3.75 |

| Grand Foundry Ltd | 5.00 |

| GI Engineering Solutions Ltd | 5.30 |

| Hathway Cable and Datacom Ltd | 16.20 |

| Hotel Rugby Ltd | 5.60 |

| IL & FS Investment Managers Ltd | 7.50 |

| Landmark Property Development | 6.25 |

Penny Stocks With 1M Return

| स्टॉक नाम | समापन मूल्य (₹) |

| Vaarad Ventures Ltd | 19.6 |

| Shree Global Tradefin Ltd | 15 |

| Mishtann Foods Ltd | 11.93 |

| Suzlon Energy Ltd | 14 |

| Madhav Infra Projects Ltd | 6.42 |

| Comfort Intech Ltd | 4.86 |

| Ashnisha Industries Ltd | 22.61 |

| Kalyan Capitals Ltd | 19.82 |

| Essar Shipping Ltd | 12.4 |

Penny Stocks For Intraday

| स्टॉक नाम | मूल्य (₹) | दैनिक मात्रा |

| Vodafone Idea Ltd | 7.75 | 20,44,60,640.00 |

| Suzlon Energy Ltd | 14.00 | 13,43,15,767.00 |

| Reliance Power Ltd | 15.00 | 13,40,21,474.00 |

| Alok Industries Ltd | 17.90 | 11,63,57,650.00 |

| Hindustan Construction Company Ltd | 18.35 | 4,78,68,804.00 |

| Yes Bank Ltd | 16.20 | 4,38,15,628.00 |

| Vikas Ecotech Ltd | 3.45 | 3,98,64,953.00 |

| South Indian Bank Ltd | 18.25 | 3,15,60,258.00 |

| Dish TV India Ltd | 14.60 | 2,74,23,719.00 |

| Jaiprakash Power Ventures Ltd | 6.10 | 2,73,31,329.00 |

Pharma Penny Stocks

| स्टॉक का नाम | बाजार पूंजीकरण | कीमत |

| Syncom Formulations (India) Ltd | 733.20 | 7.80 |

| Nectar Lifesciences Ltd | 450.76 | 21.10 |

| Bharat Immunologicals and Biologicals Corporation Ltd | 99.96 | 23.15 |

| Gennex Laboratories Ltd | 81.49 | 6.04 |

| Ind Swift Ltd | 49.02 | 9.20 |

| Cian Healthcare Ltd | 43.99 | 18.00 |

| Ajooni Biotech Ltd | 39.52 | 7.80 |

| Parabolic Drugs Ltd | 34.04 | 5.50 |

| Vista Pharmaceuticals Ltd | 28.33 | 7.92 |

| Vivanta Industries Ltd | 21.10 | 20.70 |

Disclaimer: This article is for educational purposes only. Investing in penny stocks is quite risky and without complete knowledge and expertise it is not advisable to invest in penny stocks.

Here are some of the best stock sector articles based on market capitalization, daily volume, PE ratio and close price. Click on the articles to read now.

Article outline

- Introduction to Penny Stocks

- Defining Penny Stocks

Brief history and popularity

Characteristics of Penny Stocks - low market capitalization

high volatility

lack of liquidity

Risks associated with penny stocks - possibility of fraud

limited information availability

Susceptibility to market manipulation

How to Invest in Penny Stocks - Research and due diligence

Setting realistic expectations Diversity

Strategies for Penny Stock Trading - SEC regulations

Compliance Requirements for Penny Stock Companies

Common Mistakes to Avoid - Chasing Hot Tips

Ignoring the basics

Ignoring liquidity

Benefits of Penny Stock Investing - High return potential

Access to early investors

Diversification Opportunities

conclusion - questions to ask

- What are penny stocks?

Are Penny Stocks a Good Investment?

How do I research penny stocks?

Can Penny Stocks Make Me Rich Overnight?

What are the risks of penny stock trading?

Understanding Penny Stocks: High Risk, High Reward

Penny stocks, often considered a quick way to get rich or a surefire way to lose your shirt, have long attracted investors with their promise of huge returns in a short period of time. However, dealing with the volatile world of penny stocks requires a cautious approach and a thorough understanding.

In this article, we will explore the intricacies of penny stocks, their characteristics, associated risks, investment strategies, regulatory landscape and more.

Introduction to Penny Stocks

Defining Penny Stocks

Penny stocks refer to shares of small companies that trade at relatively low prices, usually less than $5 per share. These companies often have smaller market capitalizations and are traded over-the-counter (OTC) or on smaller exchanges, as opposed to major stock exchanges such as the NYSE or NASDAQ.

Brief history and popularity

Penny stocks have been around for decades, gaining popularity among retail investors looking for high-risk, high-reward opportunities. While some investors have made substantial profits from penny stocks, others have suffered significant losses due to their speculative nature.

Features of Penny Stocks

Penny stocks exhibit several unique characteristics that distinguish them from more traditional investments:

Low market capitalization

Many penny stock companies have a market capitalization of less than $300 million, making them small-cap or micro-cap stocks. This low market capitalization often translates into high volatility and large price fluctuations.

High volatility

Because of their small size and limited liquidity, penny stocks are highly volatile, subject to rapid and dramatic price changes. This volatility can present both opportunities and risks for investors.

Lack of liquidity

Penny stocks are often illiquid, meaning there can be limited buyers or sellers at any given time. As a result, trading penny stocks can be challenging and investors may have difficulty exiting positions with large bid-ask spreads.

Risks

Penny stocks exhibit several unique characteristics that distinguish them from more traditional investments:

Possibility of fraud

The penny stock market is notorious for its susceptibility to fraudulent schemes and manipulative practices. Investors may encounter pump-and-dump schemes, where unscrupulous individuals artificially inflate stock prices before selling their shares at a profit, leaving unsuspecting investors with worthless securities.

Limited information availability

Unlike large publicly traded companies, penny stock companies often provide limited financial information and regulatory filings, making it challenging for investors to conduct due diligence. This lack of transparency increases the risk of investing in penny stocks.

Susceptibility to market manipulation

Due to their low trading volume and lack of liquidity, penny stocks are vulnerable to manipulation by market participants seeking to manipulate prices for their own benefit. This manipulation can cause significant losses to investors who are not aware of the risks.

How to Invest in Penny Stocks

Investing in penny stocks requires a disciplined approach and careful consideration of the following factors:

Research and due diligence

Before investing in a penny stock, it is essential to conduct thorough research on the company’s business model, financial health, management team, industry dynamics and growth potential. Investors should scrutinize regulatory filings, financial statements, press releases and other relevant information to make an informed decision.

Setting realistic expectations

Although penny stocks have the potential for huge returns, investors should temper their expectations and avoid chasing unrealized gains. It is important to take a long-term view and focus on companies with strong fundamentals and growth potential.

Diversification

As with any investment strategy, diversification is key to managing risk when investing in penny stocks. By spreading their investments across multiple stocks and sectors, investors can reduce the impact of any one stock’s performance on their overall portfolio.

Common mistakes to avoid

When investing in penny stocks, there are common pitfalls to avoid that can reduce returns and reduce investment success, including:

Hot tips chase

Relying on stock tips from friends, family members or online forums without doing due diligence can lead to poor investment decisions and losses. Investors should research penny stocks independently and avoid falling prey to hype or speculative recommendations.

Ignoring the basics

While penny stocks are often associated with speculation and momentum trading, investors should not overlook fundamental analysis when evaluating a potential investment. Assessing a company’s financial health, competitive position, industry trends and management quality is important for making informed investment decisions.

Ignoring liquidity

Investors should pay close attention to the liquidity of penny stocks before buying or selling shares. Low liquidity can result in wide bid-ask spreads, difficulty in executing transactions and increased price volatility, making it challenging to enter or exit positions at favorable prices.

Benefits of Penny Stock

Despite their inherent risks, penny stocks offer several potential benefits for investors:

High return potential

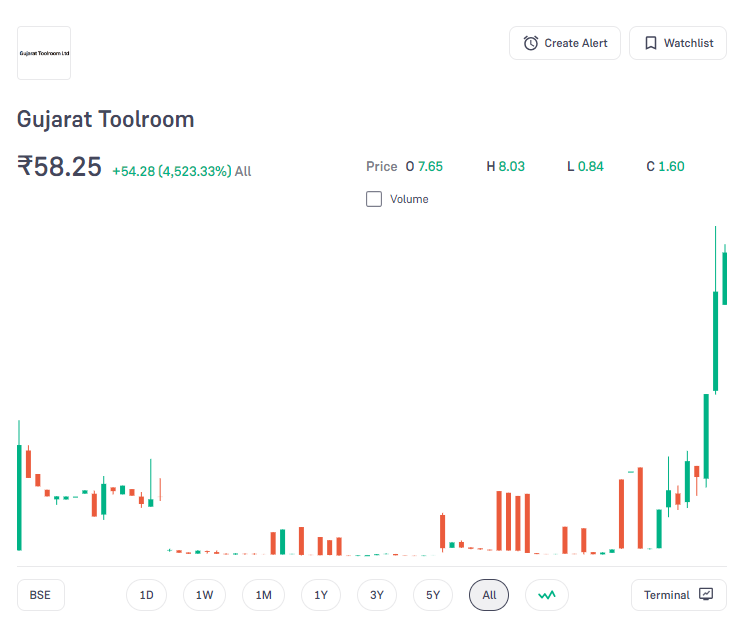

Penny stocks have the potential to generate significant returns for investors who can identify undervalued companies with strong growth potential. While not every penny stock is a winner, successful investments can yield substantial profits.

Accessibility for novice investors

Penny stocks are more accessible to novice investors with limited capital, as they can be purchased at lower prices than more established stocks. This ease allows novice investors to approach the stock market and potentially build wealth over time.

Diversification opportunities

Investing in penny stocks can provide diversification benefits by adding exposure to smaller companies and specific sectors that may not be represented in larger stock indexes. By diversifying their portfolio with penny stocks, investors can spread risk and maximize potential returns.

Benefits of Penny Stock

Despite their inherent risks, penny stocks offer several potential benefits for investors:

High return potential

Penny stocks have the potential to generate significant returns for investors who can identify undervalued companies with strong growth potential. While not every penny stock is a winner, successful investments can yield substantial profits.

Accessibility for novice investors

Penny stocks are more accessible to novice investors with limited capital, as they can be purchased at lower prices than more established stocks. This ease allows novice investors to approach the stock market and potentially build wealth over time.

Diversification opportunities

Investing in penny stocks can provide diversification benefits by adding exposure to smaller companies and specific sectors that may not be represented in larger stock indexes. By diversifying their portfolio with penny stocks, investors can spread risk and maximize potential returns.

Bottom line

Penny stocks can be a profitable but risky investment opportunity for adventurous investors willing to navigate market risk and uncertainty. While the allure of instant wealth is enticing, penny stock investing must be approached with caution, thorough research and adherence to sound investment principles. By understanding the unique characteristics, risks and opportunities associated with penny stocks, investors can make informed decisions and minimize potential losses.

FAQs

- What are penny stocks?

Penny stocks are shares of small companies that trade at relatively low prices, typically below $5 per share. These stocks are often characterized by their high volatility and lack of liquidity. - Are penny stocks a good investment?

Penny stocks can offer significant return potential but also come with significant risks. Investors should carefully evaluate the risks and rewards before investing in penny stocks. - How do I research penny stocks?

Researching penny stocks involves analyzing a company’s business model, financial health, management team, industry dynamics and growth potential. Investors should scrutinize regulatory filings, financial statements, press releases and other relevant information. - Can Penny Stocks Make Me Rich Overnight?

While some penny stocks have the potential to deliver substantial returns, overnight wealth is not guaranteed. Investing in penny stocks requires patience, discipline and a long-term perspective. - What are the risks of trading penny stocks?

Risks of penny stock trading include fraud, limited availability of information, susceptibility to market manipulation, high volatility, lack of liquidity and potential for significant losses.