Introduction Of Expiry Trading Strategy

What is Expiry Trading?

Define expiry trading (focus on derivatives like options and futures).

Expiry trading is the deliberate purchase and sale of derivatives, especially futures and options, as their expiration dates draw near. In order to profit from the price fluctuations that frequently take place as these financial instruments approach their final settlement, traders must engage in this process. The value of options and futures can change dramatically as the expiry date approaches because of things like market sentiment, volatility, and time decay.

In order to lock in gains or reduce losses, traders may use a variety of tactics, such as rolling positions, exercising options, or closing out contracts. Navigating the intricacies of the futures market successfully requires an understanding of expiration trading dynamics, which may provide both possibilities and hazards that need careful planning and timing.

Importance of expiration dates in derivatives markets.

The significance of expiration dates in derivatives markets cannot be overstated, as they play a crucial role in determining the value and trading strategies associated with various financial instruments. Expiration dates mark the point at which a derivative contract, such as options or futures, ceases to exist, compelling traders to make critical decisions regarding their positions. These dates influence market dynamics, as they can lead to increased volatility and trading volume as participants rush to either exercise their options or close out their positions.

Furthermore, understanding the implications of expiration dates is essential for risk management, as they can affect pricing, liquidity, and the overall strategy employed by traders. In essence, expiration dates serve as pivotal milestones that shape the behavior of market participants and the performance of derivatives, making them a fundamental aspect of trading in these complex financial arenas.

Why traders focus on expiry: Opportunities for profit, volatility, and risk management.

Because expiration dates offer special chances for profit-making, increased market volatility, and efficient risk-management techniques, traders are especially interested in them. There is a greater chance of price swings as options and futures contracts go closer to expiration, which makes it easier for traders to profit from transient changes. Because traders can use leverage to increase returns on their positions, this volatility may present substantial profit potential.

Furthermore, traders are able to refine their overall trading tactics and hedge against any losses by putting precise risk management approaches into practice due to the approaching expiry. Traders can more successfully traverse the market and make well-informed decisions that support their financial objectives by comprehending the dynamics of expiry.

Key Concepts to Understand

Basics of Expiry in Derivatives

Anyone trading derivatives must have a solid understanding of the principles behind expiry. The day when a derivative contract, such as an options or futures contract, is resolved and becomes void is known as the expiration date.

The contract’s life cycle ends on this day, which is important since it means the holder has to either exercise their rights, if any, or allow the contract to expire. Because traders frequently modify their positions in the run-up to expiry in order to control risk or take advantage of possible price moves, expiry dynamics can have a significant impact on market behavior.

Popular Expiry Trading Strategies

Straddles and Strangles Strategies

Two common options trading techniques used by investors to profit from market volatility are strangles and strangles.

Buying a call and a put option for the same underlying asset with the same strike price and expiration date is known as straddling. When a trader expects substantial price movement but is unsure of the direction, this method works very well.

A strangle, on the other hand, is comparable but entails purchasing a call and a put option with separate strike prices, usually out-of-the-money. Because the options are less expensive, this strategy may be less costly than a straddle; but, it needs a more significant price change in order to be lucrative.

Gamma Scalping Strategies

Gamma scalping is an advanced trading technique that uses dynamic options position management to profit from changes in the price of the underlying asset. This technique’s traders concentrate on the idea of gamma, which quantifies the rate at which the delta of an option changes in connection to the underlying asset’s price movement.

Gamma scalpers try to maintain a neutral delta by constantly modifying their positions—buying or selling the underlying asset as its price changes—in order to reduce risk and maximize possible gains.

This method is popular among seasoned traders who want to take advantage of short-term market volatility because it necessitates a deep comprehension of market movements and the capacity to respond quickly to changes.

Factors Influencing Expiry Trading

How IV spikes near expiry.

As an option’s expiration date draws near, the implied volatility (IV) behavior typically shows noticeable rises. As traders wait for possible changes in the market, the underlying asset’s price movement becomes increasingly unpredictable, which leads to this phenomenon. The demand for options may increase as the expiration date draws closer, which would increase volatility.

Factors that could affect the asset’s value, like earnings reports, the release of economic data, or noteworthy market occurrences, frequently cause this surge. Because of this, traders need to be on the lookout for possibilities as well as hazards in their trading tactics. Making wise choices in the options market requires an understanding of IV near expiry dynamics.

Time Decay (Theta): Accelerated erosion of option premiums.

As options get closer to expiration, their value rapidly decreases. This phenomenon is known as time decay, or theta. This phenomenon happens when the option’s premium declines as the amount of time left for it to turn a profit decreases.

Traders see a rapid decline in the option’s value as the clock runs out since there is less chance that the option will result in a positive conclusion. Options traders must comprehend this idea because it emphasizes how vital time is to their tactics and how important it is to manage positions well in order to minimize losses brought on by this unavoidable downturn.

Case Studies/Examples

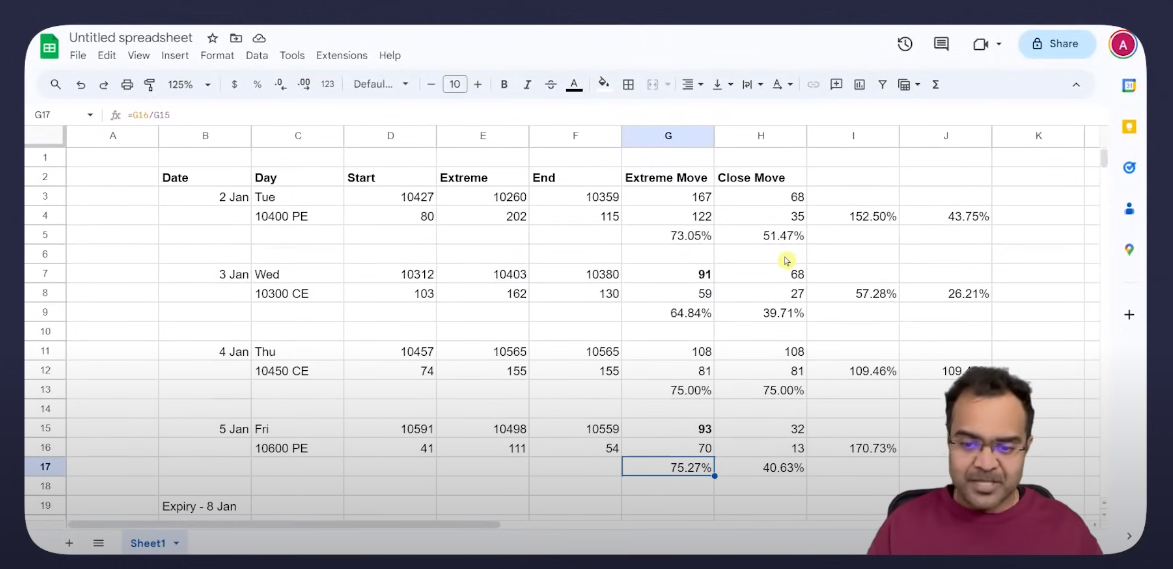

Example 1: Nifty/Bank Nifty Options Expiry (Indian markets) or SPX (US).

Example 2: Crude Oil Futures Roll-Over.

Risks and Mitigation

Common Risks:

Pin risk, liquidity gaps, sudden volatility drops.

Overnight assignment risks in options.

Risk Management Tips:

Use stop-loss orders.

Avoid holding illiquid contracts.

Hedge with offsetting positions.

Bottom line

Recap the importance of timing, discipline, and risk management.

Achieving success requires discipline, timing, and risk management. Maintaining discipline guarantees steady progress toward objectives, but knowing when to take action may make all the difference. Effective risk management also aids in navigating ambiguities, protecting investments, and improving judgment.

Encourage readers to paper-trade strategies before live execution.

Before investing actual money in live markets, readers are strongly encouraged to hone their trading techniques through paper trading. People may test their strategies in this virtual trading environment without having to worry about losing money, which is a great way to improve methods, comprehend market dynamics, and gain confidence.

By doing this, traders may learn more about how they make decisions and see possible problems, which will help them be more prepared for real-world trading situations. Stressing the value of this initial step might result in subsequent trading experiences that are more informed and more fruitful.

Final tip: "Expiry trading is high-reward but high-risk—always prioritize education over impulse."

Although expiration trading has a lot of potential benefits, there are also a lot of hazards involved. As a result, studying and comprehending market dynamics should take precedence over impulsive behavior. By devoting time to knowledge, traders may navigate the intricacies of this trading method and make well-informed decisions that increase their chances of success.